7 Ways Digital Wallets Are Changing The Fintech Industry

Technology is now everywhere in the world, actually somehow competing with the air. Almost every sector is actively integrating itself with technology.

The financial industry is not left behind. A storm has taken over the old-fashioned banking systems by fintech. For example, with a mobile money wallet, you can transact anywhere at your comfort.

What is a Digital Wallet?

It is a simplified version of your financial bank accounts made accessible through a mobile phone, computer, smartphone, or even intelligent device.

They eliminate the need to carry along with your actual wallet. An example of a digital wallet is Paypal or Google Pay. These wallets store your payment card information, and you can access them anytime.

They facilitate the processing of payments and access to payment details. Also, they enable the prices of goods and services without physical appearance to the bank.

Digital wallets statistics

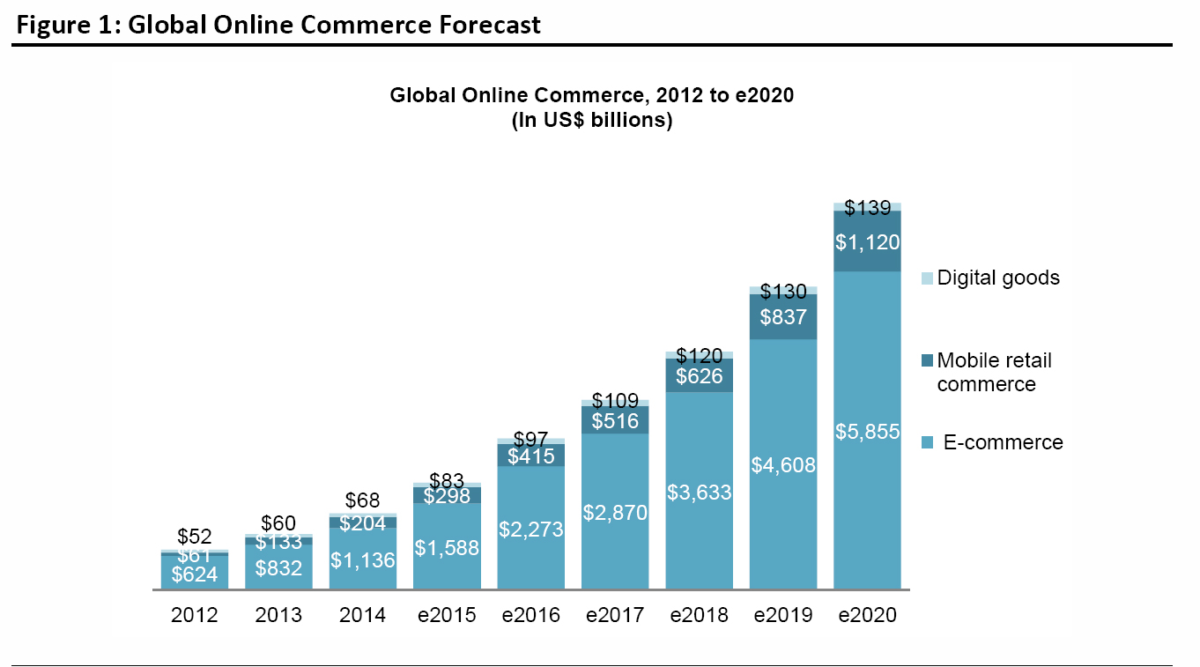

According to Forester, statistics state that by 2023 digital payments will jump up to $250 billion. In research conducted in July 2021, at least 155 million American adults have used digital wallets once in their lifetime.

In Europe, 36% of all transactions will be digital payments by 2027. The main factors attributed to the considerable uptake of digital wallets include convenience, security, and high demand for commercials. Countries using e-wallets are China (48%) UK (23%), and Japan 26%.

Top Features For Digital wallets

- Transfers between banks.

Instant transactions from one bank to another or the particular bank or withdraw conveniently. The wallets allow recurring deposits or withdrawals from one account to another and document the ledgers affected by the transactions.

These instance payment models are easy to track and execute. The wallets usually have a friendly and easy user interface.

- Bill payments

Most people look forward to this as a way to pay bills in time. People prefer to pay their electricity, water, telephone, rent, loans, etc., online.

Most wallets have features like an instant reminder when bills are paid on particular days of the month. Also, they can retain the details of the previous transactions; thus, not much energy scratching heads on the accounts details.

- Quick Registration

People are constantly looking for a way they can save a few coins. Opening an account with digital wallet platforms is free of charge. Almost every digital wallet has the same procedure to register an account followed by an OTP password.

The steps include:

- Download and install the app

- Register with your mail

- To confirm your registration put OTP sent on your email

- Reset your password and the username

- Link the wallet with your bank account or unified payment interface

- Add money and start transacting

- Rewards, Discounts, and Coupons

We all love discounts and rewards. These wallets regularly offer discounts to their customers at fascinating deals upon transactions.

Other rewards include loyalty points that motivate users to use them when transacting constantly.

- Chatbox

Another fantastic feature is the chatbot which allows a customer to chat with the app on query or support. Most companies use Artificial intelligence features to develop chat boxes.

Chatbox plays a more significant role in a wallet as it is available 24/7 and instantly offers instant feedback on issues raised. In addition, it helps the management and wallet owners in critical areas to focus on to improve their services.

Ways Digital Wallets Trends in Finetech

1. AI and ML-powered wallets

Artificial Intelligence (AI) and Machine Learning (ML) have significantly changed how the fintech industry operates. Both modes have quickly digitized the sector by integrating with high-end innovation robotic capabilities.

Most businesses have incorporated chatbots to recognize voice-based transactions and perform transactions, e.g., numbers checking.

2. Cryptocurrency Wallets

The future of online money is heading to crypto. Most businesses have crypto wallets worth multi-million dollars, which any organization or specialist does not hold up.

Since 2012 more money has been helping on crypto e-wallets, and still, more companies are actively developing more cryptographic wallets for the crypto markets. From 2016-2019, statistics data indicated that crypto wallet users rose from 6.7 Million to 347.6 million people.

Owning digital currency is advantageous due to its low risk and daily increasing new trends, thus making it more competitive and profitable. However, just like any other e-wallet, you need a digital account to be able to have crypto.

3. Biometric Wallet.

Biometric technology has come in handy when dealing with money. They include;

- 1. Fingerprint recognition.

- 2. Eye recognition

- 3 Facial

It is interesting to note that every person has unique features distinct from another, and using biometrics as a security checker is highly effective. It eliminates fraud cases and appeals.

4. Smart Voice Wallets

Wallets are now enhanced to recognize the voice brilliantly. Once the system identifies your voice, the transaction process commences. This method was first propelled by Amazon, where Google and Apple have incorporated the technology into their platforms.

28% of the digital users are now transacting effectively to get or send cash.

5. Foreign Remittances of Money

Sending money to family and friends living in other countries is accessible in the comfort of your home. It is worth noting all nations account for money transferred to a country from other countries that are contributing to the GDP.

6. Virtual Cards

Virtual cards are slowly diminishing in the financial sector. Initially, you have to add assets and input 16 digits on your card to transact with a card. In addition, you indicate its security code and expiry date. The e-wallet takes care of all the above.

7. Robotics Process Automation

RPA process is beneficial in the automation of backend transactions. It includes processing credit cards, accounts maintenance security checks, and many more. When an organization has adopted RPA, staff have the advantage of quick execution of their work, and they can perform other tasks relating to customers’ issues.

The actual net worth of a digital wallet goes beyond the transactions. They have unprecedented customer satisfaction, which gears customer data and information to transact more quickly at an enjoyable platform.